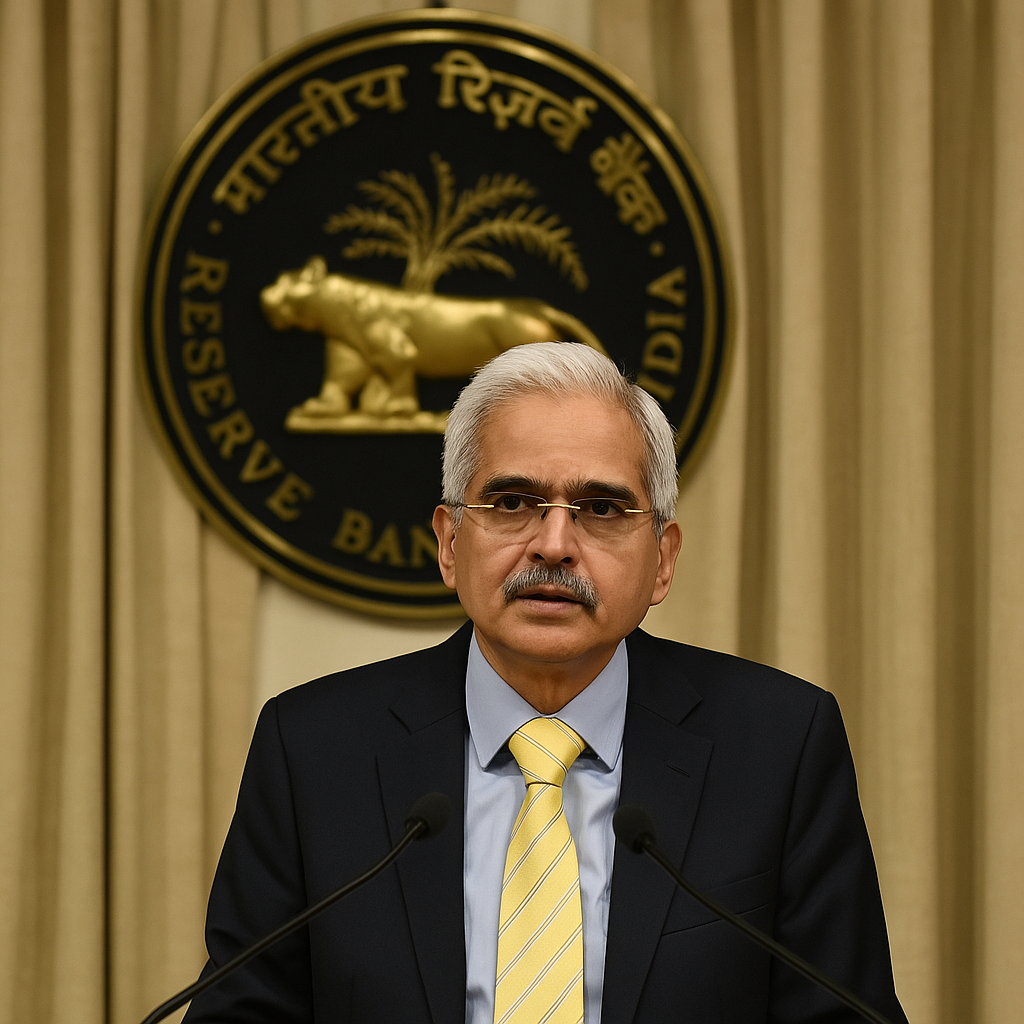

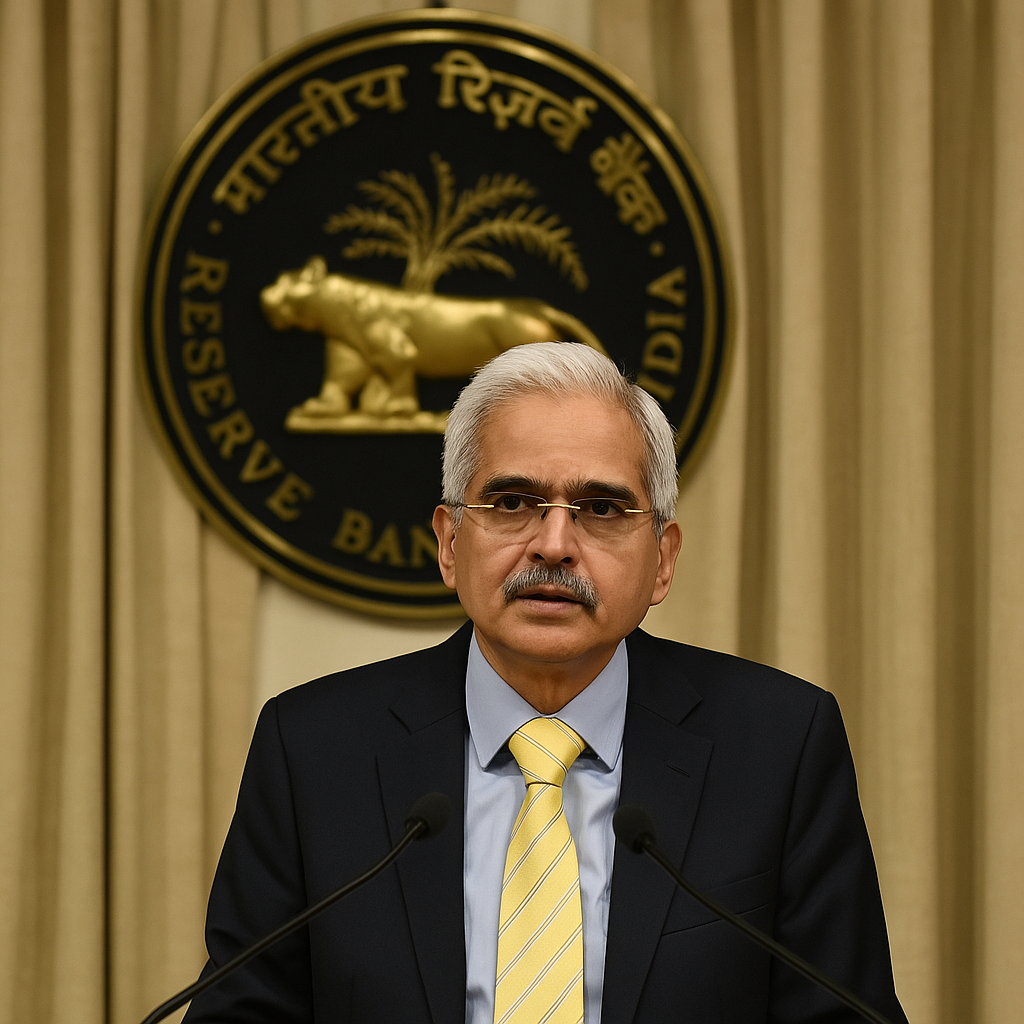

Reserve Bank of India Policy Decision 2025

The Reserve Bank of India (RBI) is expected to announce its latest monetary policy decision amidst global economic uncertainties triggered by recent U.S. tariffs on Indian exports. Experts anticipate a dovish policy stance to stimulate economic growth and maintain market stability.

With the inflation rate forecasted at 4.2% for the fiscal year 2025-26, the RBI may opt for measures such as interest rate cuts or liquidity support to encourage investment and consumption.

Industry analysts highlight that sectors like textiles and apparel, which benefit from increased global competitiveness, could see growth. However, gems and jewellery exports—especially those reliant on the U.S. market—may face pressure due to higher tariffs and reduced demand.

This policy decision is crucial for shaping India’s economic momentum amid shifting global trade dynamics. Investors and businesses across sectors are closely watching the RBI’s moves as they could significantly impact lending rates, business operations, and consumer spending.

https://newsvibe24x7.com/reserve-bank-of-india-policy-decision-2025/